To attract a new batch of customers, KeyBank didn’t turn to the mega-rich, but instead it wooed the poor.

The Ohio-based bank, which operates 61 branches in Maine, started a program here last year to offer low-cost check-cashing services and and free money orders to people who lacked bank accounts.

The program was part of a push by banks in Maine to reach out to the so-called “unbanked,” those who have no bank accounts at all, and the “underbanked,” who are consumers who may have one savings or checking account but rely on costly alternative financial services such as non-bank money orders, check cashing centers, payday loans, rent-to-own services, or pawn shops.

About 2.6 percent of Maine households, or 14,000 households, were unbanked as of 2010, according to the Pew Charitable Trusts. That’s better than the national average of 7.7 percent. When it comes to the underbanked, however, the percentage rises to 18 percent in Maine — on par with the national average.

The unbanked and underbanked vary and include low- and moderate-income people who feel they don’t have enough money to open an account, those who may have bounced checks in the past and are unable to get new accounts, or immigrants who are unfamiliar or distrustful of the U.S. banking system, experts said.

“You can find the underbanked everywhere. Rural areas and cities. Western parts of the state in York and Oxford counties. There are pockets of immigrants in Portland and Lewiston,” said Lloyd LaFountain III, superintendent of Maine’s Bureau of Financial Institutions.

About 20 percent of all U.S. households earnings $30,000 or less lack a bank account, according to the Pew Charitable Trusts.

The recession has pushed more people out of the banking system, putting pressure on state and federal regulators to try to reach out to that population.

While supporting low-fee or no-fee accounts is hardly a money-maker for banks, a spotlight has been put on the subject by heavyweights such as by former President Bill Clinton and the Gates Foundation.

The costs to have a bank account, including minimal balances and monthly maintenance fees, put accounts out of reach of many. In Maine, an average bank balance of $1,500 is needed in Maine to avoid monthly maintenance fees, according to the Pew Charitable Trusts.

Some banks are working to change access to lower cost banking.

Bath Savings was one of nine banks nationally to participate in a Federal Deposit Insurance Corp program aimed at the underserved, and low- and moderate-income consumers. The bank said it issued debit cards, free online banking and electronic bill payment to roughly 100 consumers. Customers needed only a $25 deposit to open the account.

Bath Savings marketed its program as a “second chance” account for unbanked customers and as a first transaction account for college students. The bank plans to continue offering the product in its nine locations because the one-year test was more successful than expected, according to Rebecca Launer, Bath Savings’ senior vice president of branch administration.

“The common wisdom about banks or the general view is that banks are only for the few. That’s a myth. We really are there to help people, no matter what their circumstances,” said Sterling Kozlowski, president of KeyBank’s Maine District. “Sometimes people think banks are just for working professionals. But you see everyone when you’re a bank. We have homeless people as customers.”

The KeyBank Plus program set up a check-cashing service with a 1 percent transaction fee, which is below the average 1.5 percent to 3.0 percent average in Maine for check-cashing fees and below the 10 percent fee charged by some check-cashing centers. Under the program, every fifth check cashed is free. Participants get five free money orders when a check is cashed.

“They get to do their transaction at a much lower fee. It brings them into the bank and helps reduce their fears of banks,” Kozlowski said.

Spending high rates to cash checks or get money orders is a burden for many poor families. The Pew Charitable Trusts estimated that the average unbanked household spends $86.83 a month in fees to cash checks and get money orders.

Over a lifetime, the average full-time unbanked worker will spend $41,600 in check-cashing fees, according to the Brookings Institute.

“When you really start adding up money orders, it becomes costly fast for a family each month,” said Leslie Linfield, executive director of the Institute for Financial Literacy in Portland. “It’s about moving from high-fee, check-cashing providers into more sound financial institutions.”

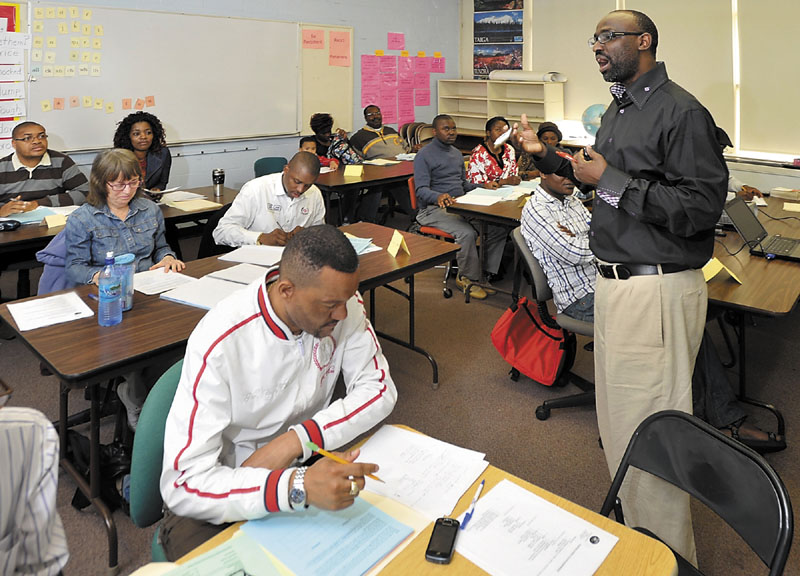

Claude Rwaganje, founder and executive director of Community Financial Literacy, said immigrants may not trust banks because financial institutions in their home country may have been unstable or corrupt. Community Financial Literacy is a three-year-old Portland organization that provides group classes and one-on-one financial education.

“Not trusting the bank is a main hurdle. We try to teach that it’s safe to use the bank. A checking account is more safe than putting money under the mattress,” said Rwaganje, a native of the Democratic Republic of Congo who has been in the U.S. for 16 years. “The misconceptions of banks, mixing with culture and religion, are barriers to banking.”

Banks need to learn the needs and fears of poor and immigrant customers so they can better serve them, experts said.

For example, the issue of receiving interest on an account can be a deterrent to some, said Rwaganje, who explained that interest is taboo in the Islam religion. Rwangnje teaches classes to educate people how to open checking or savings accounts without running afoul of cultural or religious concerns.

“There’s sensitivity out there. Maine banks are doing their part to get people to walk through their doors,” LaFountain said.

Two years ago, the Bureau of Financial Institutions and members of the Maine Legislature worked together to develop a plan of action to help the unbanked.

The group developed a brochure that was distributed to social service agencies to help low-income people and immigrants learn about low-cost or no-cost account options in Maine, basic information about banking and as well as questions to ask when opening an account.

“We learned there was a fear of banking. We did identify among immigrant groups a concern about the safety and soundness of financial institutions,” LaFountain said.

Chantie Makanda, an immigrant from the Democratic Republic of Congo, attended a class on Friday offered by Community Financial Literacy to learn about banking, credit cards and budgeting. Makanda, who has been in the U.S. since November and in Maine since February, said she doesn’t have a bank account now but aims to get one once she gets settled and gets a job.

“I have to learn the in-and-outs. The American financial system is very different from home,” Makanda said.

Send questions/comments to the editors.

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Hi, to comment on stories you must . This profile is in addition to your subscription and website login.

Already have a commenting profile? .

Invalid username/password.

Please check your email to confirm and complete your registration.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why.

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.