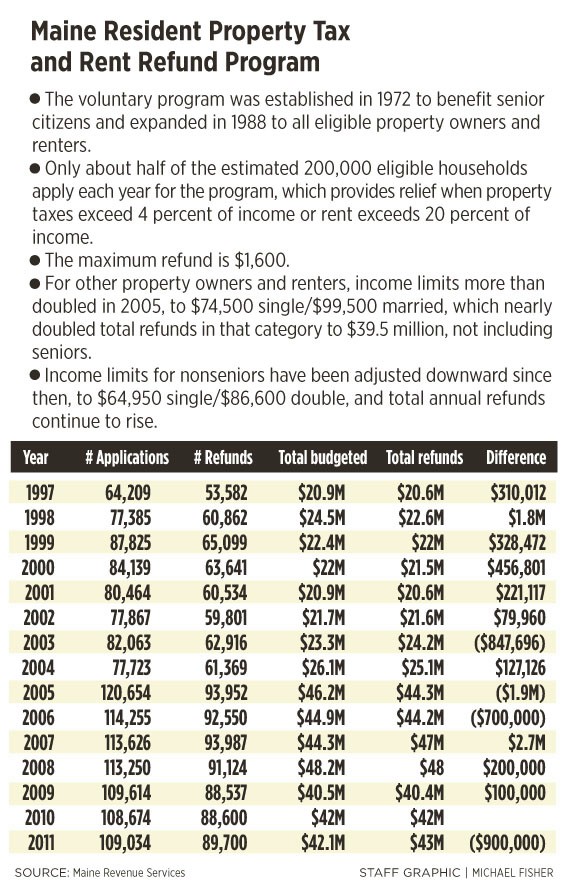

Each year, about half of the estimated 200,000 eligible households in Maine apply for a property tax or rent refund from the state. Given the average refund was $479 last year, consistently low participation in the Maine Resident Property Tax and Rent Refund Program is a curiosity, officials said, especially in a tough economy.

Overall participation last year was nearly 10 percent lower than it was three years before the recession hit, from 120,654 applications in 2005 to 109,034 applications in 2011, according to Maine Revenue Services.

Experts believe people don’t apply for the voluntary tax relief program for a variety of reasons. Some don’t know it exists or assume they don’t qualify. Others find the application form too complicated or they don’t want to deal with Maine Revenue Services any more than they must.

Or, like Michael Ackerson, a 27-year-old software developer who rents an apartment in Fairfield and works in Portland, they’re just too busy.

“My accountant suggested I look into the program, but I’ve been right out straight at work lately,” Ackerson said recently. “I’ll definitely take advantage of it, though, now that I know more about it.”

State and local tax officials say they do what they can to inform people about the income-based refund program and help them apply, but they say most so-called circuit-breaker tax programs have low participation rates.

A study by the American Association of Retired Persons found a 40 percent participation rate among similar voluntary tax-relief programs, which have been adopted by about two-thirds of the states and the District of Columbia, according to the Lincoln Institute of Land Policy.

Started in 1972, Maine’s program provides partial refunds to residents for property taxes or rent paid the previous calendar year. Applications are accepted Aug. 1 through May 31 each fiscal year.

“The program is designed to provide relief to people whose property taxes or rent represents a disproportionate amount of their income,” said Sen. Richard Rosen, R-Bucksport, who is chairman of the Legislature’s Approriations and Financial Affairs Committee.

Rent refunds are considered tax relief because tenants pay property taxes through their landlords.

“Tenants may not realize they qualify because they lose sight of the fact that a portion of their rent goes to property taxes,” Rosen said.

In broad strokes, single Mainers may qualify this year if their income in 2011 was $64,950 or less; Mainers with spouses or dependents may qualify if their household income last year was $86,600 or less.

Qualified applicants are eligible for a refund if their property taxes were more than 4 percent of income or if rent was more than 20 percent of income. Other factors may influence whether an applicant gets a refund, including investment income, public assistance and child support. The maximum refund is $1,600.

Residents who are at least 62 can either apply the same way as everyone else or, if it makes sense, under a special Senior Refund Program. The special program for seniors is limited to households with incomes less than $14,700 (single) or $18,200 (spouse or dependents), and the maximum refund is $400.

The state calculates refunds in the way that provides the greatest benefit.

It got easier to apply for the refund program in 2004 when Maine Revenue Services started offering electronic filing, which now accounts for about one-third of all refund applications, said Dennis Doiron, director of the state’s income and estate tax division. Participation in the refund program may be on the rise this year, though it’s too early to tell.

Applications were up more than 6 percent and refunds were up 9 percent in August, compared with the first month of the refund program in 2011, Doiron said.

The total dollar amount of refunds so far this year is up 16 percent, from $15 million in August 2011 to $17.4 million last month, Doiron said. Maine Revenue Services has budgeted $43.1 million for the program this year, up from $42.1 million last year.

If the refund program exceeds the budgeted amount, state revenue officials will cover the difference with any revenue surplus, said Michael Allen, Maine’s associate commissioner for tax policy.

That’s what happened last year, when the refund program exceeded its $42.1 million budget by $900,000. Revenue officials dipped into the state’s $20 million revenue surplus, Allen said.

In addition to promoting the program on the state’s website and through local libraries, Maine Revenue Services counts on municipal officials to help get the word out. Most cities and towns post notices in their municipal offices and on their websites. That’s true for South Portland, which offers its own property tax relief program for longterm residents age 70 and older.

Susan Borelli, South Portland’s finance office manager, said she and her colleagues field daily questions from residents about both programs.

“We try to educate the public whenever we can,” she said. “If someone makes a comment about their taxes, we let them know about the programs.”

Not everyone who applies for a state property tax or rent refund gets one, but most do. Of the 41,450 households that applied in August, 90 percent (37,193 households) got refunds averaging $468, Doiron said.

Each July, the state sends applications for the refund program to residents who applied the year before or requested an application on their Maine income tax form.

Still, revenue officials say, there’s only so much they can do to encourage homeowners and renters to take advantage of the refund program.

“Some people know about it and have decided they don’t want toparticipate,” Allen said.

Send questions/comments to the editors.

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Hi, to comment on stories you must . This profile is in addition to your subscription and website login.

Already have a commenting profile? .

Invalid username/password.

Please check your email to confirm and complete your registration.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why.

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.