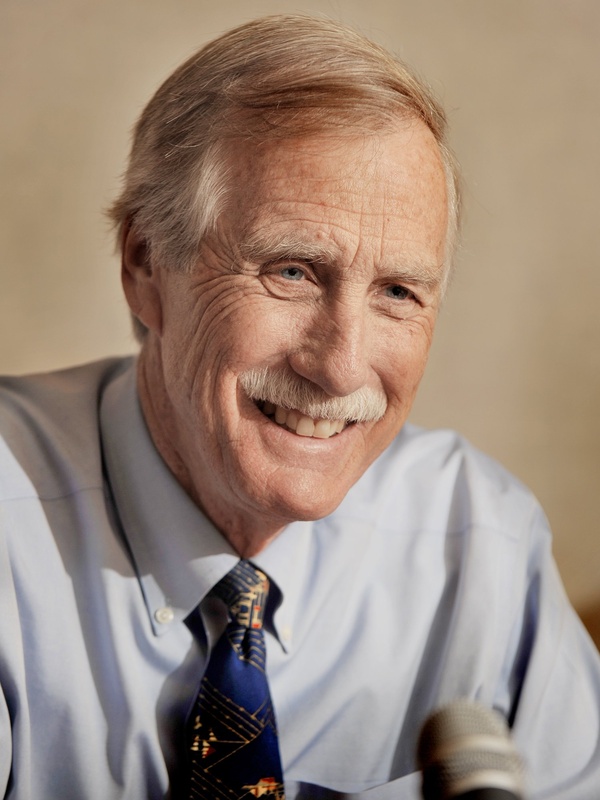

Former Gov. Angus King defended himself Tuesday against accusations that his involvement with a federally monitored Portland bank shows he has a history of fiscal mismanagement.

The Maine Republican Party issued a statement late Monday pointing out that King served on the board of directors of The Bank of Maine, which has been operating under a federal compliance order since shortly after King’s departure this spring.

In an interview Tuesday, King said he was part of a turnaround effort at the bank before he stepped down from its board of directors to run for the U.S. Senate.

“This was a Maine institution with 330 jobs that was about to go under,” said King, who is running as an independent.

King is the independent frontrunner in the race for Maine’s open U.S. Senate seat, and Republicans are hoping to create an opening for the GOP nominee, Charlie Summers. The party issued a second release late Tuesday suggesting King’s departure from the board of a Bermuda-based investment company in 2010 is another example of his poor financial track record.

The Maine Republican Party’s latest criticism of King is intended to build on the message of a recent $400,000 television ad campaign by the U.S. Chamber of Commerce that called him “the King of mismanagement” for his handling of the state budget as governor.

“He’s a nice guy I’m sure. But he just has a real history of fiscal management and Maine needs results, not another nice guy,” said David Sorenson, communications director for the Maine Republican Party.

King, who has defended his record of budget management as governor, spoke at length Tuesday about his time on the board of The Bank of Maine between September 2010 and March.

Federal regulators uncovered financial problems at the thrift in 2009, when it was still called the savings Bank of Maine and well before King was involved. The bank was having difficulty covering loan losses because of poor loan decisions and the downturn in the economy, according to news reports at the time and the current CEO.

The Office of Thrift Supervision issued a cease and desist order, restricting the bank’s loaning activities and setting deadlines for it to boost cash reserves to cover its problem loans. The order, which was amended in March 2010, said the company could be forced to sell its assets if it didn’t increase cash holdings.

John Everets, the current CEO, led a recapitalization in May 2010, investing $60 million and keeping the bank in business.

Everets and partners brought in a new management team and a new board of directors that included top executives in finance and some Maine business experts. Everets said he recruited King, who had built and sold an energy business before becoming governor, because of his knowledge of the state and his business relationships.

“He brought a lot of business savvy to the bank. We miss him,” Everets said.

The recapitalization and efforts to shed problem loans eased the concerns of federal regulators, who lifted its business restrictions in January 2011. The bank began building a new loan portfolio, while gradually removing problem assets, Everets said.

The bank was the subject of another regulatory review in the summer of 2011. This time it was the Comptroller of the Currency, which has been imposing a new regime of banking rules as part of the so-called Dodd-Frank Wall Street reforms.

Regulators again identified problem loans remaining on the bank’s books, as well as the need for new compliance controls at the bank. The concerns were discussed by the Everets and the board members, including King, last summer and fall. King and Everets said the bank moved quickly to address the regulators’ concerns.

“It was mostly things that everybody knew,” King said Tuesday. “I think the assumption was the turnaround would be faster.”

King resigned from the board in March, soon after announcing he would run for the Senate. He said he did not want to give the appearance of a conflict of interest if someone who was given a loan from the bank then donated to his campaign.

In May, the company’s remaining board of directors signed a formal agreement setting new deadlines for the bank to implement a list of new compliance measures, such as reating a compliance committee and a risk reduction plan.

The formal agreement says “the Comptroller has found unsafe and unsound banking practices and regulatory violations,” and that the bank was being designated as in “troubled condition.”

Sorenson at the Maine Republican Party said the order shows King’s efforts on the board didn’t help. “I think it’s clear the problems at the bank were not cleared up during angus time there and this is another example in a clear pattern of mismanagenent,” he said Tuesday.

King, meanwhile, said the company is still in the midst of a turnaround and that he’s glad to have contributed in a small way.

“The problems with the bank predate the current management and what they’ve been doing for two years is righting the ship,” he said. “This was a case of stepping in to save 300-plus Maine jobs and it looks good.”

Everets said the bank is still gradually removing old, problems loans. But it also has built a new $200 million loan portfolio that is solid. The bank also now has $80 millon in cash reserves and $120 million in other liquidity, he said.

A review of balance sheets shows the company’s assets have shrunk from $890 million in 2008 to $775 million this year, and that cash reserves have increased dramatically.

“It’s a great balance sheet now,” Everets said.

Everets said the transition to new federal regulations under Dodd-Frank means compliance agreements are becoming more common.

Formal agreements are the most common form of compliance orders and much less severe than cease and desist orders. Eighty five banks have been issued formal agreements this year, including one other bank in Maine, Auburn Savings Bank.

The existence of a formal agreement means regulators have compliance concerns but doesn’t necessarily mean financial mismanagement or risk of a bank failure, said Gretchen Jones, a lawyer who represents banks but has no connection to The Bank of Maine.

“In 20-something years, I think I can fairly say I have never seen an examination that doesn’t result in a (signed memorandum or letter),” she said. “Generally the regulators will come in and they will manage to fund something that isn’t done to their satisfaction.”

Jones also said descriptions such as “unsound” or “troubled condition” are routine legal terms that allow the regulators to set compliance deadlines. “That’s how they wield the hammer,” she said.

The King campaign also responded late Tuesday to the latest criticism from Maine Republican Party about his 2010 departure from the board of W.P Stewart & Co. Ltd., a Bermuda-based investment company. The GOP said it didn’t have details about King’s role there, but that King left after the stock slid the year before and during a takeover that led to a corporate turnaround.

King said through a spokeswoman that he left the board when a new owner came in and brought in his own board members.

King also said Tuesday it doesn’t make sense to hold board members responsible for every up or down in the business world.

“I’m also on the board of Lee Auto and they had one of the best years in their history last year.” King said. “Does that make me a financial genius?”

The campaign manager of Kings’ Republican opponent, Charlie Summers, said Tuesday he didn’t know enough details about King’s corporate board activities to comment on the GOP criticisms. “The one thing that we are very familiar with is his financial mismanagement of state government,” Lance Dutson said.

Copy the Story LinkSend questions/comments to the editors.

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Hi, to comment on stories you must . This profile is in addition to your subscription and website login.

Already have a commenting profile? .

Invalid username/password.

Please check your email to confirm and complete your registration.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why.

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.