Hosting fundraising events or donating to charities can help raise a business’ profile in a community as well as provide support for the needy. However, understanding what is required of business owners under Maine law can be difficult.

An Augusta restaurant recently found that out when it received a cease-and-desist letter from the state Office of the Attorney General advising the owners they could be running afoul of the state law governing charitable organizations.

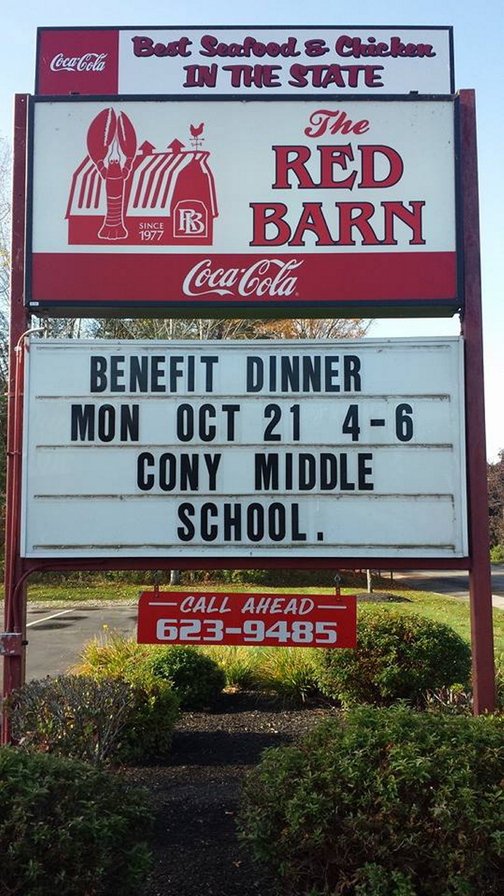

The Red Barn, a family restaurant on the city’s east side, has been holding fundraisers for community groups and individuals in need since 2009. It started as a way to attract more customers when the restaurant was struggling, owner Laura Benedict said Thursday.

The restaurant started holding all-you-can-eat meals with suggested donations that went to various local organizations. Benedict said she did that every Monday night for the first two years, but she was inundated with requests from organizations and individuals in need. The restaurant now holds them every other Monday during the winter.

“It worked almost immediately and it revitalized the business,” Benedict said.

People who had never been to the restaurant before started visiting from Augusta and the surrounding communities. It wasn’t cheap to serve all the meals, she said, but the fundraising events provided invaluable word-of-mouth advertising.

“We would have gone out of business if we didn’t change the way we did business. Giving back is the first thing we did, and it worked,” Benedict said.

Overall, the restaurant has raised $635,000 since 2009 for local organizations and individuals, according to Benedict.

So she was stunned when she received a letter from the Office of the Attorney General telling her to stop holding charitable events until the restaurant is licensed as a charitable organization or shows why it does not need a license. Attorney General Janet Mills visited the restaurant last weekend and apologized for the letter’s tone. Mills’ spokesman, Tim Feeley, said the office probably will call businesses in the future to warn them they may need to register and that the tone of the letters will be softened.

Benedict said that although the letter she received caused “a couple of sleepless nights,” she’s glad about it. The restaurant received an outpouring of public support, and the letter kickstarted a plan to form a nonprofit organization to handle all the company’s charity efforts.

It also caused local legislators to begin researching whether the state law governing charitable solicitations could be improved. Rep. Lori Fowle, D-Vassalboro, submitted a bill title last week to begin the process of finding out whether the law should be amended in the upcoming legislative session. Fowle said she’ll work with the attorney general’s office to determine what, if anything, should be changed to make fundraising easier for small businesses.

Rep. Matthew Pouliot, R-Augusta, said he would like to hear from other businesses or organizations about their experiences interacting with the law.

The Charitable Solicitations Act, enacted in 1977, is designed to give the public a place to go to determine whether a charity is legitimate and to learn more about the organization, said Doug Dunbar, spokesman for the Department of Professional and Financial Regulation, which regulates the charitable solicitations program. Each year, the department works with the attorney general to send about a dozen letters warning businesses that they may need to register with the state. That number could drop moving forward, however, following changes to the state law this year.

The law was streamlined to ease the burden for smaller nonprofit organizations and make it less likely that businesses would need some type of license, Dunbar said.

The amendments signed into law by Gov. Paul LePage in June increased the fundraising threshold requiring charities to seek a license, from $10,000 to $35,000 a year. They also eliminated a type of license a business would need to raise money in partnership with a charitable organization.

Previously, businesses could be considered commercial co-venturers if they conducted a fundraising activity in conjunction with a charity, requiring the businesses to get a license from the department or seek an exemption.

“We did away with that license category altogether, which should make it less likely that a business would need any sort of license if they’re engaged in any particularly (charitable) activity,” Dunbar said.

Brenda Peluso, director of public policy and operations at the Maine Association of Nonprofits, which helped amend the law, said businesses and small charities still find some regulations hard to understand.

“It’s something that’s always been a little fuzzy. It’s hard to figure out,” she said.

Peluso said a business such as the Red Barn might need a professional solicitor license if it receives money as part of a fundraiser to pay for food or servers.

The attorney general’s office is working with the Red Barn to confirm it doesn’t fall under the definition of being a professional solicitor, Feeley said.

Jamie Boulette, managing director for PFBF CPAs, an accounting firm with offices in Oakland and Bath, said the company has people contribute directly to charities when hosting its annual half-marathon and 5-kilometer race to avoid running afoul of the law’s requirements.

The company has been holding charity runs in Oakland since 2010. Last year, it raised more than $12,000 for Special Olympics Maine, Boulette said.

Besides raising money for a nonprofit each year, he said, the company sees the event as its chief marketing effort.

“CPAs in general are viewed as most trusted advisors,” Boulette said. “To establish yourself, you have to maintain a leadership role in the community as an individual or a firm, and we’ve tried to do it with the presence of our firm.”

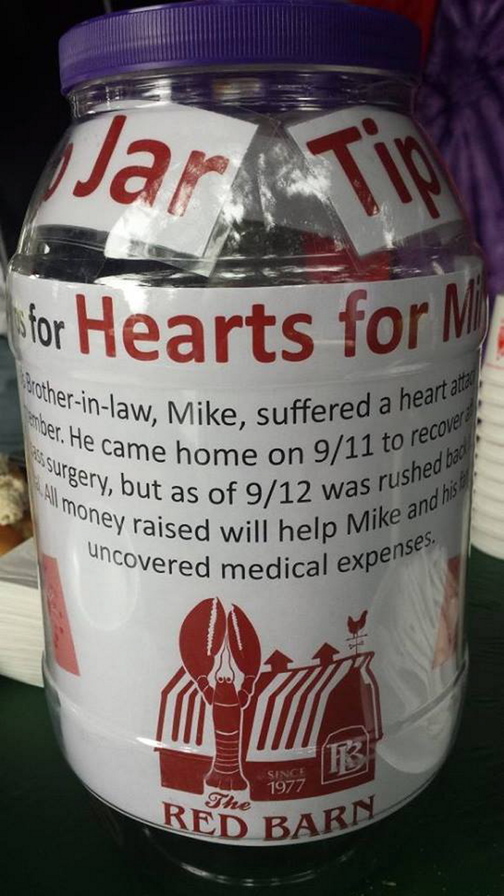

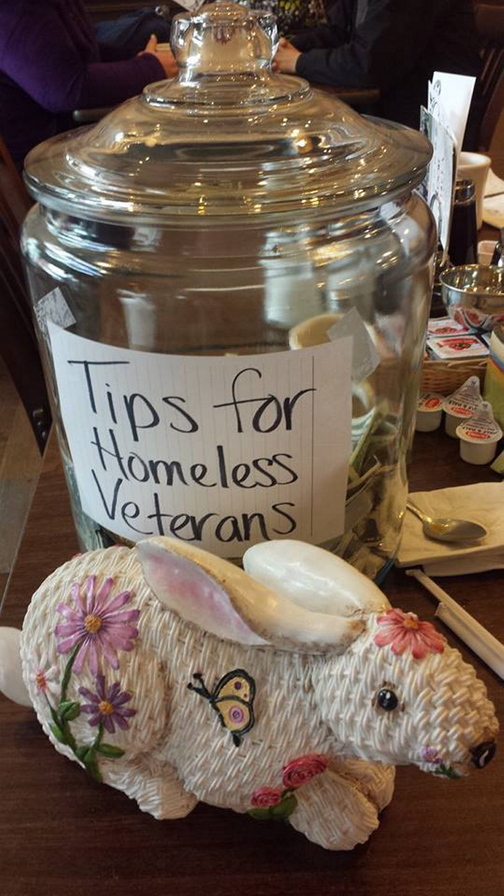

Alicia Barnes, business manager of the Red Barn, said as a result of discussions with the attorney general’s office, the restaurant will stop holding raffles at fundraising events and stop raising money by donated tips collected at charity dinners.

The restaurant still is holding a charity dinner Monday for the Skating Association of Maine. Through recent discussions about the event, however, the parties discovered the association wasn’t registered as a charitable organization with the state, Barnes said. She said the association will rectify that by Monday.

The hitch reinforced the one lesson Benedict said she learned from the ordeal: Check the laws first.

Dunbar said that although it’s unlikely a business would need a license if donating all of the money raised to an organization or individual, people should call the program to make sure.

“The bottom line is, because there are nuances to things, any business owner or representative of a community organization is really encouraged to call the charitable solicitation program to talk to the staff,” he said. “The staff is knowledgeable and friendly and wants to be helpful.”

The charitable solicitations program can be reached at 624-8603.

Paul Koenig — 207-621-5663 pkoenig@centralmaine.com Twitter: @paul_koenig

Send questions/comments to the editors.

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Hi, to comment on stories you must . This profile is in addition to your subscription and website login.

Already have a commenting profile? .

Invalid username/password.

Please check your email to confirm and complete your registration.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why.

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.